Market Commentary | December 30th, 2024

Week in Review…

Major U.S. equity indices demonstrated mild gains for the week, primarily influenced by the Federal Reserve’s announcement of fewer anticipated interest rate cuts for 2025. This revelation heightened investor caution amidst persistent market volatility. For the week ending December 27, 2024:

- The S&P 500 closed at +0.67%

- The Dow Jones Industrial Average gained +0.35%

- The tech-heavy Nasdaq rose +0.76%

- The 10-Year Treasury yield concluded at 4.62%

Given the holiday on Wednesday and a half day on Tuesday, the markets were not as packed with earnings reports and economic data. However, there were several key reports released last week that should give the markets plenty to analyze. The week saw a mixed bag of news for several key sectors.

- Real estate demand appears solid, though perhaps not as red-hot as initial forecasts suggested. November’s building permits data was revised downward, yet it still significantly outpaced original projections, indicating strong builder confidence. Month-over-month new home sales rebounded with a 5.9% increase, confirming that last month’s hurricane-disrupted figures were an outlier. The actual number of new home sales was a slight miss, but still in line with expectations. Overall, housing demand is in line with expectations, albeit slightly less amazing than originally stated.

- In contrast, manufacturing demand appears sluggish. Both headline and core durable goods orders fell short of expectations. Core Durable Goods Orders, a preferred metric excluding volatile aircraft orders, came in at -0.1% versus the projected 0.3%. This suggests manufacturers may be cautious about future demand and less inclined to make large purchases.

- Consumers sent mixed signals this week. On Monday, the Conference Board’s consumer confidence report was significantly weaker than expected, raising concerns about economic activity. However, Friday’s data showed a sharp decline in crude oil inventories (4.237 million barrels versus a forecast of 0.700 million), suggesting continued strong demand for discretionary items like travel. This report capped a month where crude oil inventories exceeded expectations four out of five weeks. The market now faces the challenge of reconciling these conflicting surveys and hard data points.

- Recent Treasury auctions underscore a trend of rising yields across maturities. Last week’s auctions of the 2-, 5-, and 7-year Notes saw yields increase notably compared to November: 2-year yields rose 6.1 basis points (bps), 5-year yields climbed 28.1 bps, and 7-year yields surged 34.9 bps. This pattern suggests a bear steepening of the yield curve, implying the market anticipates continued economic growth alongside inflation. However, given recent periods of high inflation, it is uncertain how much inflation the market will tolerate. The Federal Reserve will need to carefully navigate its communication to manage expectations.

Spotlight

The Santa Rally of 2024: A Year-end Market Phenomenon

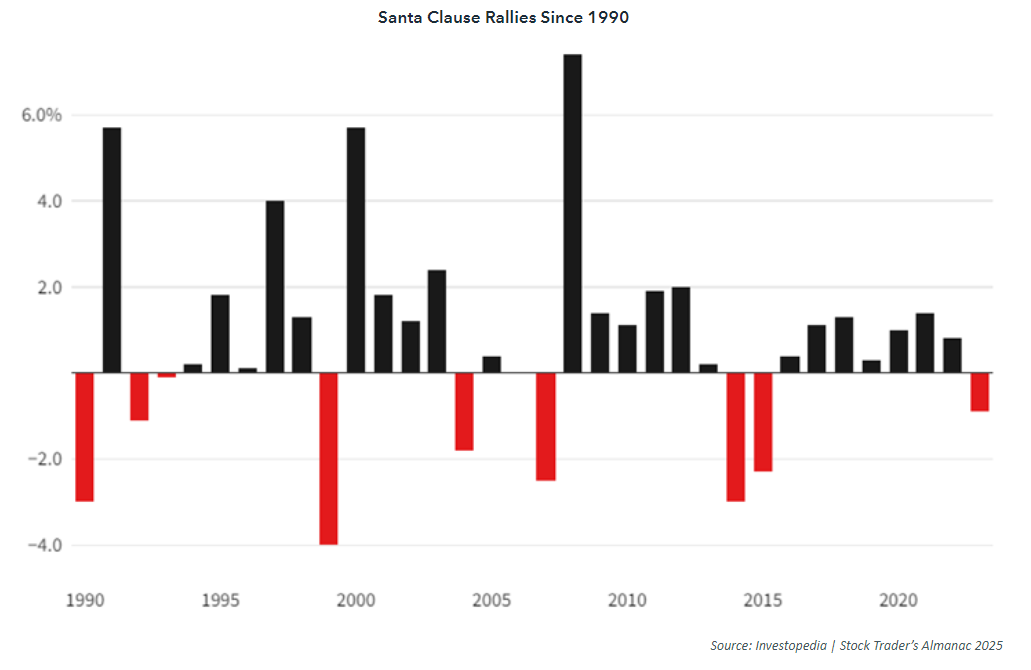

As the year draws to a close, investors and traders alike turn their attention to a well-known market phenomenon: the Santa Claus Rally. This term, coined by Yale Hirsch in 1972, refers to the tendency for stock markets to rise during the last five trading days of December and the first two trading days of January. The Santa Rally is often seen as a period of optimism and positive sentiment, and 2024 has been no exception.

Historical Context and Significance

Historically, the Santa Claus Rally has been a reliable, albeit modest, period of gains for the stock market. According to the Stock Trader’s Almanac, the S&P 500 has averaged a 1.3% gain during this seven-day trading window since 1969. This period is often characterized by lower trading volumes, as many institutional investors take time off, which can reduce resistance to upward price movements. Additionally, retail investors, buoyed by holiday bonuses and end-of-year optimism, often drive additional buying.

The 2024 Santa Rally

The 2024 Santa Rally kicked off on December 24 and will run through January 2. This year, the rally has been particularly anticipated due to a volatile December, where major indices experienced significant fluctuations. Recent trading sessions have shown positive movements, driven by a resurgence in tech stocks and overall market optimism.

Factors Which May Be Driving the Rally in 2024

Several factors contribute to the Santa Claus Rally. One key driver is investor sentiment. The holiday season often brings a wave of positive sentiment, as investors look forward to the new year with optimism. Additionally, tax considerations play a role, as investors may engage in tax-loss harvesting or repositioning their portfolios ahead of the new year.

Another factor is the lower trading volumes during the holiday season. With many institutional investors on vacation, there is less resistance to upward price movements, allowing for more significant gains. Retail investors, who are more active during this period, often contribute to the rally by making year-end purchases.

Looking Ahead

While the Santa Claus Rally is a well-documented phenomenon, it is not guaranteed. Broader economic events, geopolitical tensions, or bearish sentiment can easily disrupt the rally. However, the historical consistency of this trend makes it a point of interest for traders and investors.

As we move into the final days of 2024 and the first days of 2025, all eyes will be on the markets to see if the Santa Claus Rally will deliver its usual cheer. Whether you’re a seasoned investor or a market newcomer, understanding the dynamics of this period can provide valuable insights into market behavior and help inform your trading strategies.

Week Ahead…

The final week of 2024 and the start of 2025 are expected to have very few economic data releases. The key focus will be the ISM Manufacturing Purchasing Managers’ Index (PMI), which forecasters expect to remain below the 50 threshold, signaling continued contraction in manufacturing. This marks the ninth consecutive month of contraction, reflecting persistently soft demand. However, there are signs that the decline is moderating as companies shift their focus to planning for 2025.

Looking back on the year, against a backdrop of uncertainty, the U.S. economy has so far managed a remarkable soft landing. Despite initial concerns, the economy avoided a recession, with unemployment remaining low, albeit showing signs of weakening toward year-end, and inflation moderated significantly. The Federal Reserve’s approach to monetary policy played a crucial role. Contrary to market expectations of six rate cuts at the beginning of the year, the Fed delivered only three. Despite this restrained easing, the economy and markets adjusted well, with the S&P 500 surging nearly 30% year-to-date as of late December.

Market participants are approaching 2025 with a more tempered outlook. While optimism remains, for 2025 projections from major institutions like Morgan Stanley and Goldman Sachs suggest the S&P 500 could climb to 6500—still a solid gain from current levels, but reflective of moderated growth expectations.

In addition, the Federal Reserve’s latest economic projections also signal cautious optimism. Most officials foresee a 2% GDP growth rate, a slightly softer labor market, and fewer rate cuts than previously anticipated.

While future market performance cannot be predicted with certainty, the sentiment appears to favor a return to more measured growth in 2025.

As we bid farewell to a volatile 2024, we wish everyone a prosperous and fulfilling new year.

This content was developed by Cambridge from sources believed to be reliable. This content is provided for informational purposes only and should not be construed or acted upon as individualized investment advice. It should not be considered a recommendation or solicitation. Information is subject to change. Any forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The information in this material is not intended as tax or legal advice.

Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Socially responsible investing does not guarantee any amount of success. Clients and prospective clients should be prepared to bear investment loss including loss of original principal. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is not a guarantee of future results.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange.