Weekly Market Commentary | September 9th, 2024

Week in Review…

U.S. stock markets experienced a significant downturn this week, marking their worst performance since March 2023:

- The S&P 500 fell 4.25% for the week

- The Dow Jones Industrial Average declined by 2.93%

- The Nasdaq Composite plummeted 5.77%, leading the losses among major indices

- The 10-Year Treasury yield closed at 3.71%

This past week was a busy one for investors as they received a plethora of U.S. macroeconomic data. The Federal Reserve has explicitly stated it will be data-dependent when it comes to handling monetary policy, and investors will try to use the information provided last week to anticipate the Federal Reserve’s policy decision during their next meeting (September 17-18). The economic reports themselves are useful barometers, but how the reports will influence the Fed’s decision has taken some precedence.

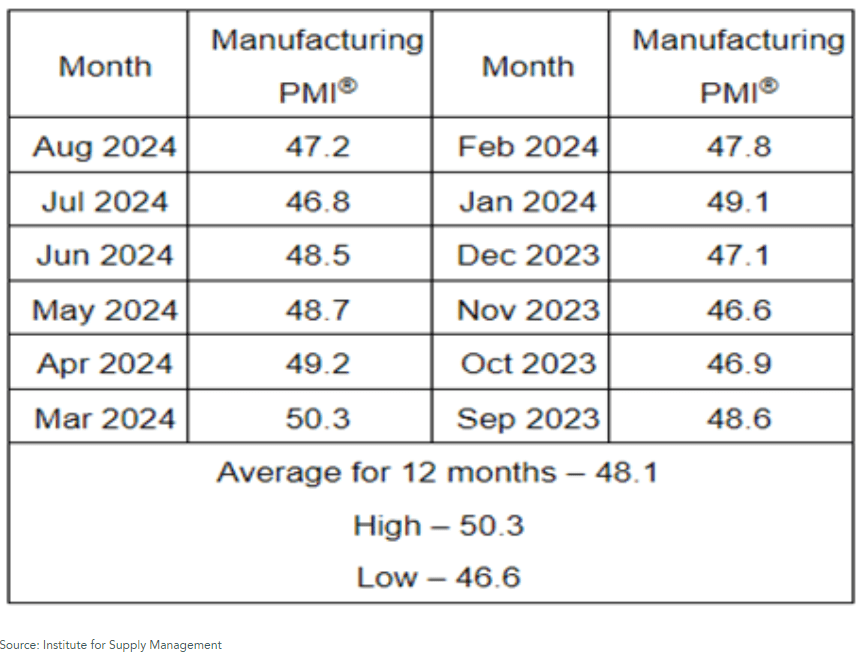

The Manufacturing Purchasing Managers’ Index (PMI) was a miss to the downside, with a reading of 47.2 compared to a forecasted 47.5. Although this is an increase from the previous reading of 46.8, the report still puts the manufacturing industry decisively in contractionary territory. Furthermore, a miss to the downside will continue to add bearish sentiment to the manufacturing industry. In contrast to the Manufacturing PMI numbers, the Non-Manufacturing PMI beat its forecasted numbers (51.5 compared to 51.3) and remains in expansionary territory.

Crude oil inventories were another source of good news, with actual inventories decreasing by 6.873 million compared to a projected decrease of 0.60 million. The implication here is that demand for oil, and in the economy in general, is much higher than anticipated.

The Job Openings and Labor Turnover Survey (JOLTS) report from the Bureau of Labor Statistics surprised to the downside, with an actual of 7.673 million and an estimated 8.090 million. This was a disappointing release when compared to the 8.184 million released on July 30. Non-farm payrolls received on Friday were also lower than market expectation, coming in at 142,000 compared to a projected 164,000. On the other hand, the unemployment rate hit its forecast of 4.2%.

All in all, the week of economic reports was a mixed bag. Some portions of the economy appear to be doing poorly, while others appear to be thriving or holding steady.

Spotlight

Bad News is Bad…Again

For a period of time, financial markets were responding to negative economic news in a positive way. There was a belief that if the economy began to show signs of weakness, it would convince the Federal Reserve to lower interest rates sooner rather than later. More recently, bad news about the economy has been received as bad news for the overall market. Investors are worried that the Fed might have waited too long to cut rates, which has reignited recession fears.

Three examples occurred last week during Tuesday’s sell-off on the back of weak manufacturing data, then again on Thursday as August private payrolls recorded their smallest gain since 2021, and finally on Friday as it was reported that August payrolls grew less than expected.

On Tuesday, the Institute for Supply Management (ISM) released their monthly survey of purchasing managers. The reading for the month of August came in at 47.2%, which was lower than the Dow Jones consensus of 47.9%. A reading below the 50% breakeven point suggests that the manufacturing sector continues to be in contraction territory. This weaker-than-expected reading caused a sharp decline in the S&P 500 index before recovering some of the losses.

The manufacturing sector, which accounts for 10.3% of the economy, has now been in contraction territory for the past five consecutive months. The sector has also been in contraction territory, on average, over the past 12 months.

Another example of the market reacting negatively to bad news happened on Thursday when ADP data showed that companies hired just 99,000 workers in August compared to the 140,000 that was forecasted. The August number was also well below the downwardly revised 110,000 number for the month of July and the smallest gain since January of 2021. Markets were mixed with the S&P 500 and Dow Jones both posting losses while the Nasdaq was slightly up on the day.

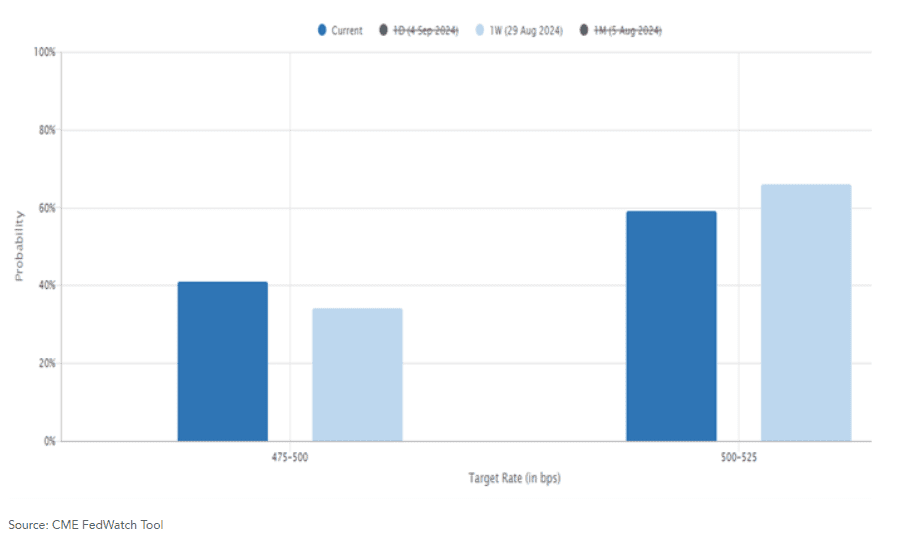

Following the ADP jobs report on Thursday, the CME FedWatch tool was pricing in a 41% probability of a 50-basis point rate cut during the September meeting. This was in contrast to the 34% probability from a week prior.

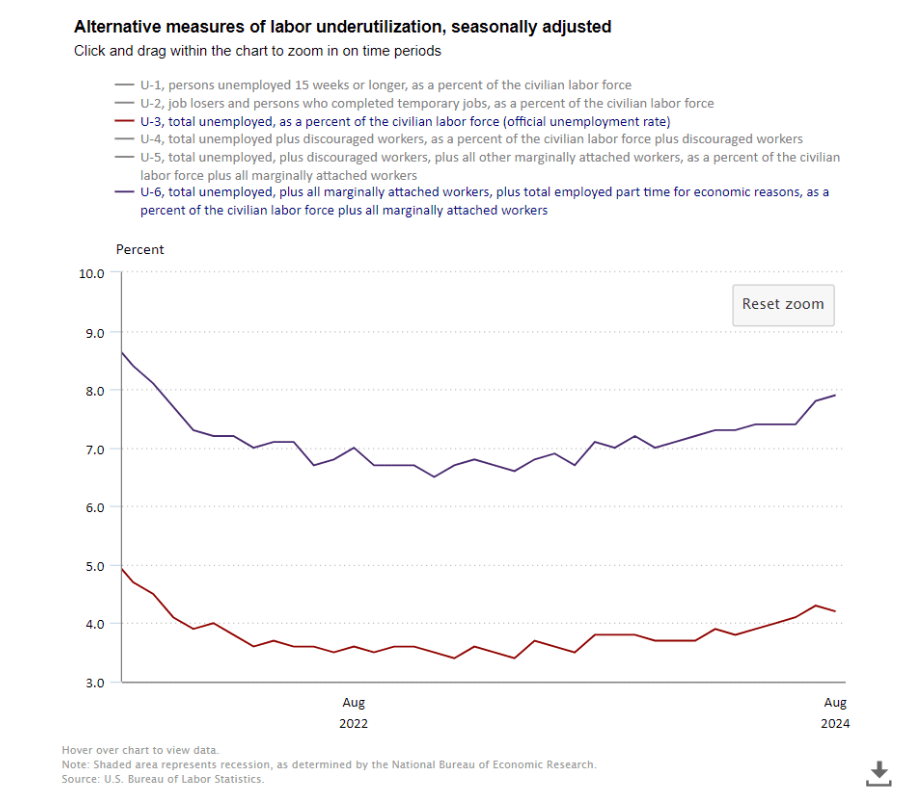

Then finally on Friday, markets reacted negatively to the jobs report released by the Bureau of Labor Statistics with all three major indices (S&P 500, Dow Jones, and Nasdaq) all recording significant losses. The report showed that nonfarm payrolls increased by 142,000 for the month of August, which was well below the consensus of 161,000 jobs. The report also showed that the “real” unemployment rate increased to 7.9% which is the highest reading since October of 2021. This alternative measure includes discouraged workers and those holding part-time jobs for economic reasons.

To end on a more positive note, the ADP report on Thursday showed that, while hiring has slowed considerably, only a few sectors reported actual job losses. Those sectors being professional business services (16,000), manufacturing (8,000), and information services (4,000). This point was further validated by the latest Labor Department data which reported lower initial claims for unemployment from a week prior. This helped ease market participants of fears over widespread layoffs. The jobs report released on Friday also showed that the unemployment rate decreased slightly to 4.2%, as was expected.

Week Ahead…

As investors gear up for the upcoming week, all eyes will be on the Consumer Price Index (CPI) inflation data. Last month saw headline inflation, a key focus of the Federal Reserve, dip below 3% for the first time in recent memory. Core CPI, which excludes volatile food and energy prices, also showed significant deceleration. Market analysts are anticipating a further 30 basis point decline in headline CPI for the upcoming release.

While CPI has been in the spotlight, the Producer Price Index (PPI) has remained under 3% since early 2023. Any unexpected upticks in PPI next week could potentially impact consumer prices. The combination of easing inflation, lower mortgage rates, and decreased gasoline prices is expected to boost consumer sentiment.

The recent cooling of inflation, coupled with a softer jobs report, has bolstered investor confidence that the Fed’s rate-hiking cycle has concluded. The focus has now shifted to the magnitude of potential rate cuts at the September Federal Open Market Committee (FOMC) meeting. Per the CME FedWatch, the current futures market pricing indicates a 73% probability of a 25-bps point rate cut, and 27% chance of a 50-bps cut.

The economic data released in the coming week will be crucial in providing investors with greater clarity on the future trajectory of interest rates.

This content was developed by Cambridge from sources believed to be reliable. This content is provided for informational purposes only and should not be construed or acted upon as individualized investment advice. It should not be considered a recommendation or solicitation. Information is subject to change. Any forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The information in this material is not intended as tax or legal advice.

Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Socially responsible investing does not guarantee any amount of success. Clients and prospective clients should be prepared to bear investment loss including loss of original principal. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is not a guarantee of future results.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange.